The end result is as though depreciation expense was never deducted as an expense. In effect, we are reversing depreciation expense because it is not an expense using the cash basis of accounting. Notice cash is not involved.) Thus to convert net income to a cash basis, depreciation expense is added back to net income. (Recall the financial accounting entry to record depreciation expense: debit depreciation expense and credit accumulated depreciation. For example, the accrual basis of accounting deducts depreciation expense in calculating net income, even though depreciation expense does not involve cash. Examine this figure carefully.Īdjustment One: Adding Back Noncash Expenses Question: What is the first type of adjustment necessary to convert net income to a cash basis?Īnswer: The first adjustment to net income involves adding back expenses that do not affect cash (often called noncash expenses). These three types of adjustments are shown in Figure 12.4 "Operating Activities Format and Adjustments", which also displays the format used for the operating activities section of the statement of cash flows. Three general types of adjustments are necessary to convert net income to cash provided by operating activities. If the resulting adjusted amount is a cash inflow, it is called cash provided by operating activities if it is a cash outflow, it is called cash used by operating activities. How do we convert this amount to a cash basis?Īnswer: Several adjustments are necessary to convert this amount to a cash basis and to provide an amount related only to daily operating activities of the business. This amount comes from the income statement, which was prepared using the accrual basis of accounting.

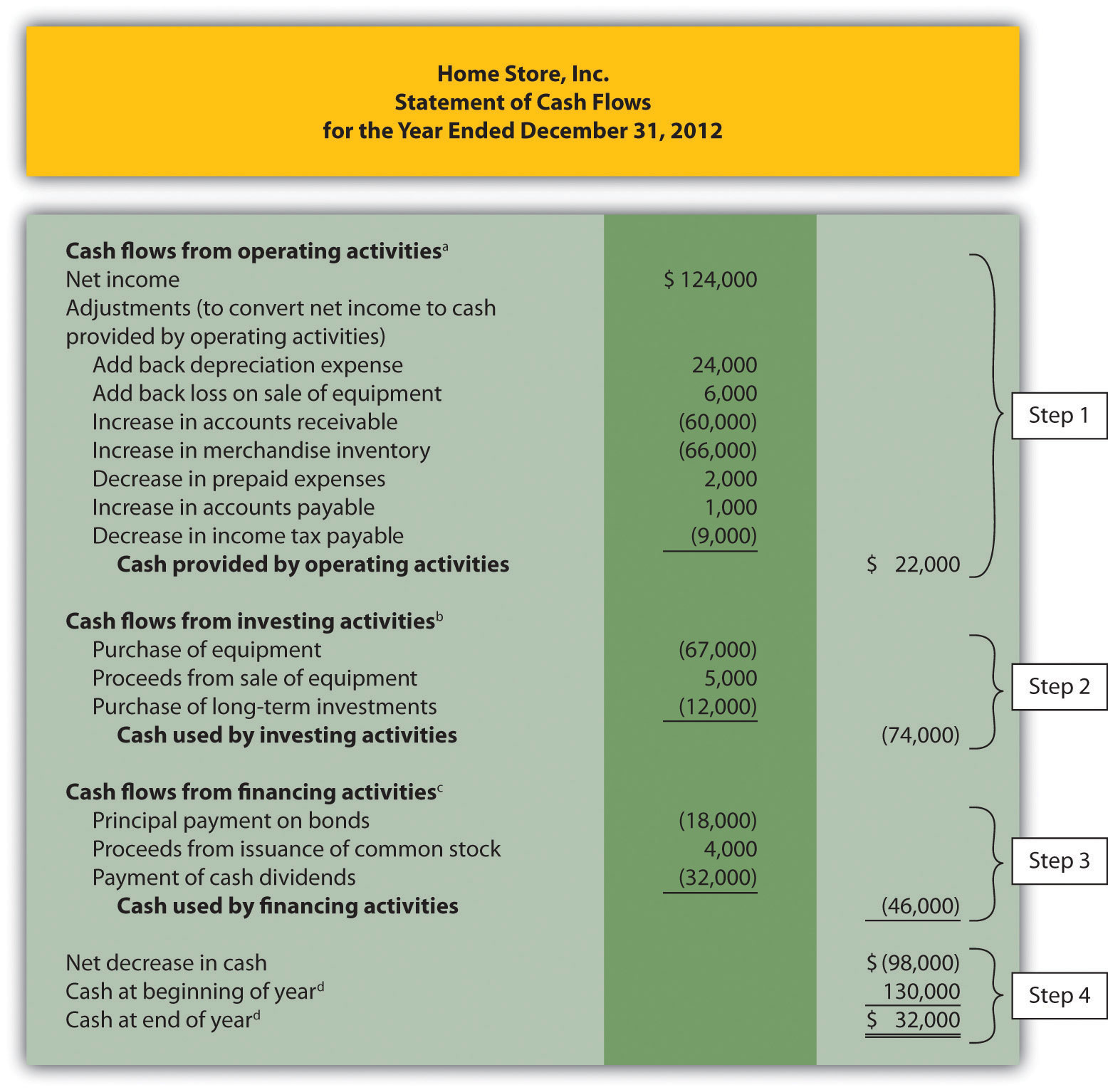

Home Store, Inc., had net income of $124,000 in 2012. (The direct method is covered in the appendix.) The starting point using the indirect method is net income. Step 1: Prepare the Operating Activities Section Question: We will be using the indirect method to prepare the operating activities section. It is important to note that all positive amounts shown in the statement of cash flows denote an increase in cash, and all negative amounts denote a decrease in cash. With these data and the information provided in Figure 12.3 "Balance Sheet and Income Statement for Home Store, Inc.", we can start preparing the statement of cash flows.

This information is presented in Figure 12.3 "Balance Sheet and Income Statement for Home Store, Inc.". Where do we start in preparing Home Store, Inc.’s statement of cash flows?Īnswer: As stated earlier, the information needed to prepare the statement of cash flows includes the balance sheet, income statement, and other selected data.

Question: Now that you are familiar with the four key steps, let’s take a look at the statement of cash flows for Home Store, Inc. Prepare a statement of cash flows using the indirect method.

0 kommentar(er)

0 kommentar(er)